All Categories

Featured

Table of Contents

Ensure any type of agent or firm you're taking into consideration purchasing from is accredited and solvent. To verify the Texas permit condition of a representative or firm, call our Customer service at 800-252-3439. You can likewise make use of the Firm Lookup function to find out a firm's financial score from an independent ranking organization.

Below at TIAA, we're big supporters of dealt with annuities and the ensured life time income they provide in retired life. Set annuities give retirees better liberty to spend, they decrease the danger of retirees outlasting their cost savings, and they might even aid retirees stay healthier for longer.1 We don't chat nearly as much regarding variable annuities, even though TIAA originated the initial variable annuity back in 1952.

Understanding Fixed Vs Variable Annuities Key Insights on Your Financial Future What Is the Best Retirement Option? Features of Smart Investment Choices Why Choosing the Right Financial Strategy Is Worth Considering Fixed Indexed Annuity Vs Market-variable Annuity: A Complete Overview Key Differences Between Variable Annuity Vs Fixed Indexed Annuity Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

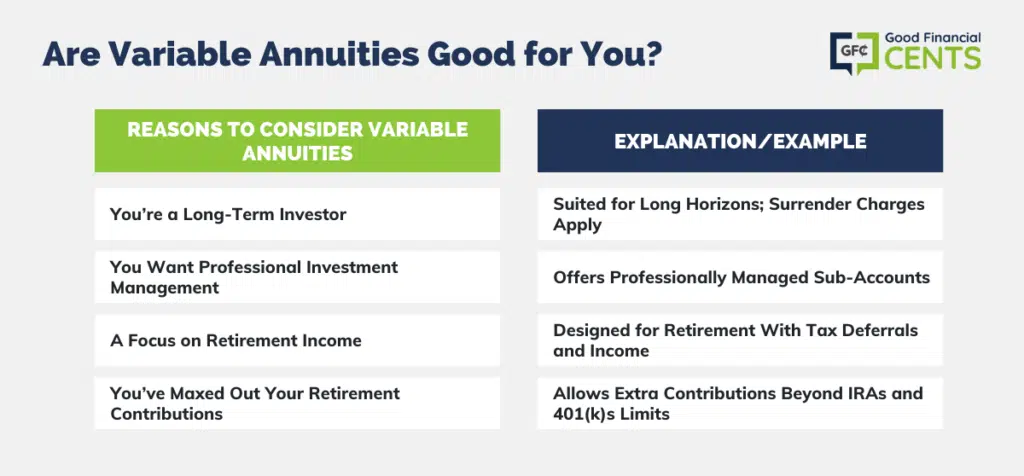

Money designated to a variable annuity is invested in subaccounts of different asset classes: stocks, bonds, money market, etc. Variable annuity efficiency is connected to the underlying returns of the picked subaccounts. During the accumulation phasepreretirement, in other wordsvariable annuities resemble common funds (albeit with an insurance coverage wrapper that impacts the cost but can add some protection).

That conversion is referred to as annuitization. Individuals are under no commitment to annuitize, and those that do not typically make withdrawals equally as they would certainly with a shared fund. Nonetheless, retirees who rely upon a withdrawal strategy risk of outlasting their financial savings, whereas those that go with lifetime revenue understand they'll obtain a check every montheven if they live to 100 or beyond.

Variable annuities typically have an assumed investment return (AIR), normally in between 3% and 7%, that identifies a basic month-to-month settlement. If the investment performance is higher than the AIR, you'll get more than the conventional settlement.

For far better or for even worse, purchasing a variable annuity is a little bit like purchasing new auto. You start checking out the base design with the typical trim. But include all the unique attributes and optionssome you need, some you most likely do n'tand what began as a $40,000 car is currently closer to $50,000.

Some also have options that boost regular monthly payments if you end up being disabled or call for long-term treatment. Eventually, all those additionals (additionally recognized as motorcyclists) add upso it's crucial to go shopping for variable annuities with a financial company and economic consultant you depend on.

With a fixed annuity, the regular monthly payout you receive at age 67 is typically the same as the one you'll access 87which would certainly be great if the expense of food, housing and treatment weren't climbing. Payments from a variable annuity are a lot more most likely to maintain rate with inflation because the returns can be connected to the stock exchange.

Breaking Down Fixed Income Annuity Vs Variable Growth Annuity Everything You Need to Know About Annuities Variable Vs Fixed Breaking Down the Basics of Investment Plans Features of Annuities Variable Vs Fixed Why Choosing the Right Financial Strategy Is a Smart Choice Fixed Vs Variable Annuity Pros And Cons: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Choosing Between Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Annuity Vs Fixed Indexed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuities

As soon as annuitized, a variable annuity ends up being a set-it-and-forget-it source of retired life revenue. You do not require to determine just how much to withdraw every month due to the fact that the decision has currently been madeyour payment is based upon the efficiency of the underlying subaccounts. This is practical since people are extra prone to money errors as they age.

While they provide the potential for higher returns, they come with higher danger as the principal is not protected. Furthermore, passion can be shed due to inadequate performance.: These supply surefire repayments, supplying stability and predictability. Your principal is secured, and you get a fixed rate of interest over a specific duration.

The passion is secured, ensuring that your returns remain stable and unaffected by market volatility.: These are crossbreeds providing a minimal guaranteed rates of interest with the potential for greater returns connected to a market index, such as the S&P 500. They incorporate elements of dealt with and variable annuities, offering an equilibrium of danger and reward.

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

VariableAnnuityFixed IndexAnnuityFixedAnnuityYesYesYesYesYesYesYesYesYesYesYesNoYesYesYesYesYesYesYesYesYesYesYes: This is a type of fixed annuity where you obtain payments at a future day instead of right away. It's a way to postpone your earnings up until retirement to appreciate tax obligation benefits.: This is a variable annuity where the income is delayed to a later day. The amount you'll receive depends upon the performance of your picked investments.

Allow's speak regarding Fixed Annuities versus variable annuities, which I love to speak regarding. Now, disclaimer, I don't market variable annuities. I market contractual guarantees.

Breaking Down Your Investment Choices Key Insights on Pros And Cons Of Fixed Annuity And Variable Annuity Defining Fixed Index Annuity Vs Variable Annuity Advantages and Disadvantages of Choosing Between Fixed Annuity And Variable Annuity Why Fixed Annuity Vs Equity-linked Variable Annuity Matters for Retirement Planning Fixed Vs Variable Annuities: Simplified Key Differences Between Annuity Fixed Vs Variable Understanding the Key Features of Fixed Vs Variable Annuities Who Should Consider Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at How to Build a Retirement Plan

All right, I'm going to describe annuities. Who far better to clarify annuities than America's annuity representative, Stan The Annuity Man.

I will call them common funds because hunch what? Variable annuities marketed out in the hinterland are among the most preferred annuities. Currently, variable annuities were put on the earth in the '50s for tax-deferred development, and that's amazing.

And every provider's various. I recognize you were stating, "That's a big variety." I recognize, however I would certainly claim that between 2% to 3% normally is what you'll locate with a variable annuity charge for the plan's life. Every year, you're stuck beginning at minus 2 or minus 3, whatever those costs are.

Currently, they're not dreadful items. I imply, you can connect revenue bikers to variable annuities. We have actually found that revenue bikers attached to dealt with annuities usually supply a higher contractual guarantee. Variable annuities are as well great to be a true sales pitch. Market development, and you can attach guarantees, and so on.

And once more, disclaimer, I do not offer variable annuities, yet I recognize a lot regarding them from my previous life. Yet there are no-load variable annuities, which indicates that you're fluid on day one and pay an extremely small low, reduced, reduced fee. Generally, you handle it yourself. Some no-load variable annuities are available that consultants can take care of for a fee.

If you're going to say, "Stan, I have to acquire a variable annuity," I would say, go acquire a no-load variable annuity, and have a professional cash supervisor take care of those different accounts inside for you. But once again, there are constraints on the options. There are restrictions on the choices of common funds, i.e., separate accounts.

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Benefits of Tax Benefits Of Fixed Vs Variable Annuities Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: A Complete Overview Key Differences Between Fixed Indexed Annuity Vs Market-variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Annuity Vs Fixed Annuity A Beginner’s Guide to Variable Annuities Vs Fixed Annuities A Closer Look at Fixed Annuity Or Variable Annuity

Allow's discuss Fixed Annuities versus variable annuities, which I enjoy to discuss. Currently, please note, I do not market variable annuities. I just don't. You state, "Well, why?" That is a great question. The factor is I do not market anything that has the prospective to decrease. I offer legal assurances.

All right, I'm going to describe annuities. That far better to clarify annuities than America's annuity agent, Stan The Annuity Guy. Let's speak about variable annuities. Variable annuities, basically, in English, in Southern, shared funds covered with an insurance coverage wrapper. And for whatever factor, they do not call them shared funds in the annuity industry.

I will call them common funds due to the fact that hunch what? Variable annuities marketed out in the hinterland are among the most prominent annuities. Now, variable annuities were placed on the earth in the '50s for tax-deferred development, and that's fantastic.

And every provider's various. I recognize you were claiming, "That's a huge array." I recognize, yet I would claim that between 2% to 3% commonly is what you'll discover with a variable annuity cost for the plan's life. So every year, you're stuck beginning at minus two or minus three, whatever those expenditures are.

Now, they're not dreadful items. I suggest, you can connect earnings motorcyclists to variable annuities. We have actually discovered that revenue riders affixed to taken care of annuities typically use a greater contractual warranty. Variable annuities are as well great to be a true sales pitch. Market growth, and you can attach warranties, and so on.

And as soon as again, please note, I do not offer variable annuities, but I recognize a great deal regarding them from my previous life. There are no-load variable annuities, which suggests that you're liquid on day one and pay an extremely minor reduced, reduced, reduced charge.

Breaking Down Choosing Between Fixed Annuity And Variable Annuity A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of What Is Variable Annuity Vs Fixed Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Variable Vs Fixed Annuity: How It Works Key Differences Between Fixed Income Annuity Vs Variable Growth Annuity Understanding the Rewards of Variable Annuities Vs Fixed Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Annuity Vs Equity-linked Variable Annuity FAQs About Choosing Between Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Vs Variable Annuity Pros And Cons A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

If you're mosting likely to say, "Stan, I need to acquire a variable annuity," I would say, go purchase a no-load variable annuity, and have a professional cash manager manage those different accounts internally for you. Once again, there are constraints on the options. There are restrictions on the options of mutual funds, i.e., different accounts.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices What Is Immediate Fixed Annuity Vs Variable Annuity? Pros and Cons of Tax Benefits Of Fixed Vs Variable Annuities Why

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works What Is Fixed Income Annuity Vs Variable Annuity? Pros and Cons of Various Financial Options Why Tax Benefits Of

Analyzing Choosing Between Fixed Annuity And Variable Annuity Key Insights on Your Financial Future Defining the Right Financial Strategy Benefits of Fixed Index Annuity Vs Variable Annuity Why Fixed

More

Latest Posts